#### GST Cuts to Give New Wings to Indian Tourism

Gopendra Nath Bhatt

With the auspicious beginning of Navratri, India enters a long festival season leading up to Diwali. Along with the festive spirit, the tourism season has officially commenced. The recent reductions in the Goods and Services Tax (GST), implemented under the leadership of Prime Minister Narendra Modi, are expected to provide a fresh impetus to tourism in the country. Cheaper travel and accommodation will attract both domestic and international tourists.

The Indian government has announced rationalized GST measures aimed at making tourism more affordable, increasing public transport usage, and supporting artisans and the cultural sector. These changes in GST slabs are expected to have far-reaching effects. The cuts will strengthen domestic tourism, promote cultural heritage, and encourage investment in related sectors, aligning with the vision of inclusive development. Hospitality, transport, and traditional crafts will see growth in employment and investment, boosting India’s tourism industry.

Prime Minister Modi highlighted these revolutionary GST reforms in his address to the nation, emphasizing their role in enhancing affordability and accessibility. The Ministry of Culture and Tourism, led by Gajendra Singh Shekhawat, expressed optimism that the reductions will attract both domestic and foreign tourists, generating revenue and employment opportunities in hospitality, transport, and handicrafts.

GST cuts will make hotel stays more affordable for the middle class and budget travelers, aligning India’s hospitality tax structure with international tourism destinations. This is expected to boost weekend getaways, heritage and eco-tourism circuits, and pilgrimages. The measures will encourage investment in mid-sized hotels, homestays, and guesthouses, creating jobs and improving infrastructure.

Reduced GST rates on buses and minibuses will benefit fleet operators, schools, corporate institutions, tourism service providers, and state transport undertakings. Public transport adoption will be encouraged, reducing congestion and pollution while modernizing bus fleets for safer and more comfortable travel.

The GST cuts also extend to cultural products, such as religious idols, small sculptures, traditional engravings, prints, stone art, and jewelry. This benefits artisans engaged in India’s traditional cottage industries, preserving temple architecture, folk expression, fine printing, and stone craft, while promoting Indian culture and heritage globally. The government is also actively supporting artisans, cultural institutions, and heritage preservation through digitization and global showcasing, giving traditional arts new economic viability.

The Modi government’s GST reforms reflect a strategic effort to strengthen tourism and cultural sectors by improving affordability, supporting traditional artisans, and promoting public transport. These measures will stimulate tourism, reinforce cultural preservation, and boost employment, investment, and economic growth.

Since GST’s introduction in 2017, periodic adjustments have been made to simplify indirect taxes and provide relief to different sectors. Recent reductions specifically target tourism and hospitality services, including hotels, guesthouses, resorts, travel agencies, tour packages, restaurants, and adventure activities. Reduced GST on hotel rooms (₹1,000–₹7,500 per night) and restaurant services (from 18% to 5%) will directly lower tourist expenses, making India more attractive for domestic and international travelers. Adventure and tour activity taxes have also been lowered, with concessions for travel agencies and online bookings.

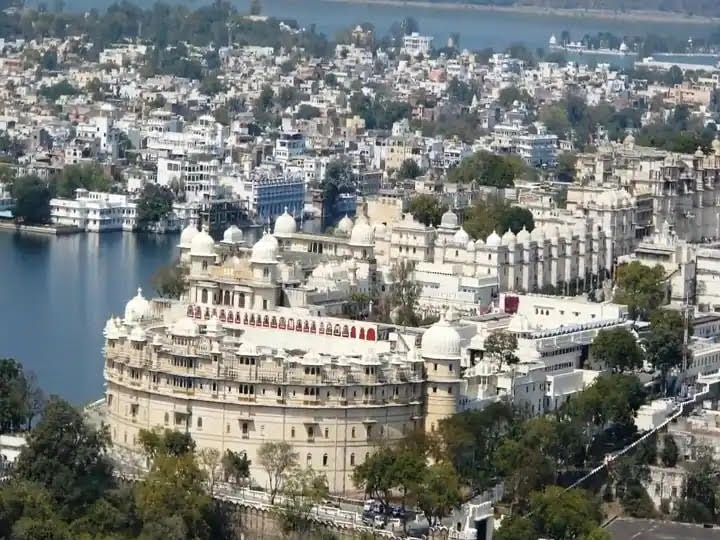

Lower taxes will make travel more accessible for middle-class families, while foreign tourists will find India increasingly attractive. The hospitality and restaurant sectors are expected to see higher demand, generating new jobs, training opportunities, and investment. Increased tourism will benefit local markets, handicrafts, transport, and allied services, boosting indirect revenue for both central and state governments. Rural and eco-tourism will also benefit, supporting homestays and emerging destinations. States like Rajasthan, Kerala, Goa, and Himachal Pradesh stand to gain significantly, as reduced taxes enhance their competitiveness in the tourism market.

These GST cuts act as a lifeline for tourism, boosting domestic and international arrivals, creating jobs, attracting investment, and accelerating economic growth. Combined with improved infrastructure, safety, cleanliness, and digital booking facilities, India could emerge as one of the top global tourism destinations by 2030, further enhancing the “Incredible India” brand.

साभार :

© CopyRight Pressnote.in | A Avid Web Solutions Venture.