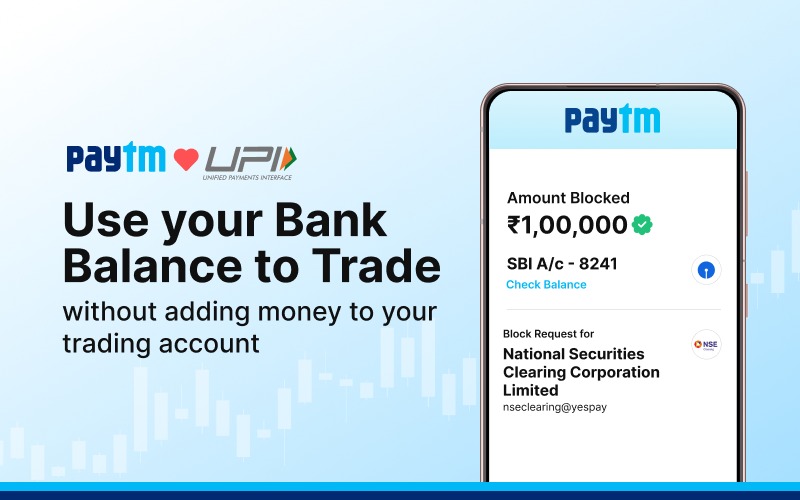

Paytm UPI has introduced a new feature that allows seamless trading on brokerage apps without requiring large fund transfers. Users can now block funds directly in their bank accounts and trade effortlessly.

With this feature, only the required amount is automatically debited during a trade, ensuring that funds remain in the bank account and continue earning interest. Currently available for Axis Bank (@ptaxis) and Yes Bank (@ptyes), it will soon expand to SBI (@ptsbi) and HDFC Bank (@pthdfc).

✔ No Fund Transfers Required – Funds are blocked directly in the bank account.

✔ Complete Transparency – Users can easily track funds via the Paytm app.

✔ Earn Interest – Funds stay in the bank account until needed.

✔ Auto Debit Payments – Trades are processed without entering a UPI PIN.

1️⃣ Log in to your brokerage platform.

2️⃣ Go to the "Add Funds" section.

3️⃣ Select the "Single Block Multiple Debits" option.

4️⃣ Choose Paytm UPI as the payment method.

5️⃣ Enter your UPI PIN to complete the process.

Recently, Paytm introduced the 'Receive Money QR Widget' and real-time payment notifications with the 'Coin-Drop Sound.' Additionally, Paytm now supports UPI payments globally, allowing users to pay via UPI in UAE, Singapore, France, Mauritius, Bhutan, Sri Lanka, and Nepal.